>33%

>33%

F1 score improvement

>35%

>35%

improvement in retrieval latency

2x

2x

increase in deployment velocity

For institutional investors, speed and accuracy are everything. From validating an investment thesis to prepping for earnings calls, analysts must extract insights from mountains of data like financial models, SEC filings, broker research, internal memos, and more. But this data is rarely clean or centralized. It’s fragmented, unstructured, and often buried in documents that take hours to parse manually.

Terminal X, a vertical AI solution designed to act as a 24/7 knowledge hub and research agent, set out to solve this. Terminal X transforms messy, siloed financial content into actionable intelligence, enabling analysts to go from question to insight in seconds. But to achieve this level of speed, precision, and scale, they needed infrastructure that could support highly contextual, low-latency retrieval across millions of documents.

Pinecone provided the foundation. With a vector database purpose-built for real-time semantic search, Terminal X was able to replace brittle keyword-based systems with a fast, scalable, and production-grade retrieval layer. The result: faster decisions, more accurate outputs, and a drastically improved experience for analysts working in the highest-stakes environments.

Breaking through the limits of keyword search

Terminal X’s mission was clear: give institutional investors access to financial superintelligence, no matter where it lives or how it’s formatted, to make better decisions. But in its early stages, the platform relied on a traditional keyword-based retrieval system combined with custom rule-based logic. While sufficient for surface-level queries, the system quickly fell short in real-world financial workflows.

Analysts often received loosely related results and had to manually comb through lengthy PDFs, spreadsheets, broker notes, and filings to piece together answers. This slowed down research and introduced risk, especially in high-stakes workflows like due diligence, thesis validation, or portfolio monitoring where a single overlooked data point can materially affect investment decisions.

As Terminal X scaled, customers—including hedge funds, asset managers, family offices, bankers, and private equity firms—began integrating proprietary internal data such as investment memos, earnings models, and real-time market feeds. As a result, the shortcomings of the legacy system became even more apparent:

- Limited context understanding: Keyword search failed to surface the exact data point or passage analysts were looking for.

- Manual effort and cognitive load: Users spent hours stitching together insights from disparate documents.

- Lack of scalability: As data volume and complexity grew, retrieval performance degraded and engineering overhead increased.

The Terminal X team of Wall Street professionals and AI engineers needed a solution that could do more than retrieve documents; they needed one that could sufficiently understand content of all kinds. At the same time, given the sensitivity and volume of financial data their clients work with, Terminal X needed a system that could not only serve queries accurately and in real-time, but also integrate smoothly into a broader architecture used by both their technical and non-technical team members.

The team thoroughly tested several potential services including MongoDB, Elasticsearch, and Milvus, but found that they lacked the production readiness, precision, or scalability needed for institutional finance. Only Pinecone offered the infrastructure to power the next generation of retrieval for Terminal X.

A production-ready retrieval stack built on Pinecone

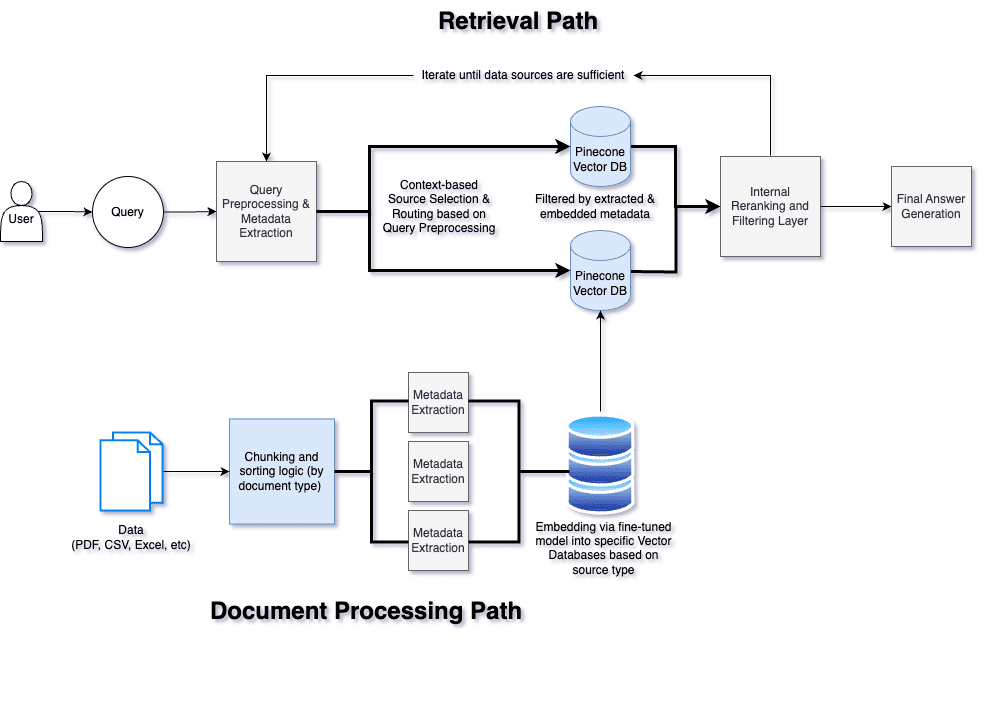

To deliver fast, accurate, and context-aware answers across massive volumes of financial data, Terminal X rebuilt its retrieval architecture from the ground up with Pinecone at the core. Pinecone now powers the vector search infrastructure behind the platform, enabling a system that combines dense retrieval, metadata enrichment, and multi-agent orchestration to mimic how a human analyst would conduct research.

Terminal X processes millions of documents in various formats: PDFs, Excel models, PowerPoints, .csv files, broker research, regulatory filings, and more. Each file is parsed, embedded, and enriched with over 60 custom finance-specific metadata tags. Pinecone indexes more than 20 million vectorized chunks across over 60 namespaces, enabling highly precise retrieval and fine-grained access control.

When a user submits a query, Terminal X routes it through a layered Retrieval-Augmented Generation (RAG) pipeline. Pinecone performs high-speed semantic vector search before the Terminal X document processing path reranks and filters results using metadata-enriched scoring logic to find the most contextually relevant piece of data, surfacing not just related documents but the exact paragraph, table, or data point the analyst needs. This retrieval flow supports complex use cases including due diligence, earnings prep, portfolio monitoring, and memo drafting.

What set Pinecone apart during evaluation was not only its retrieval performance, but also its ease of integration and ability to scale effortlessly. Its serverless, pay-as-you-scale architecture eliminated the need for complex infrastructure planning, while the API-first design allowed the Terminal X engineering team to move quickly without being slowed by operational overhead.

With Pinecone, we achieved the retrieval speed, accuracy, and scalability we simply couldn’t get elsewhere. That’s critical when serving institutional investors who depend on fast, precise insights to navigate high-stakes financial workflows. Pinecone gave us the foundation to scale to millions of documents, cut latency by over a third, and double our deployment velocity—all while simplifying our infrastructure. — Kibeom Kim, CTO at Terminal X

Accuracy, speed, and scale unlocked

By integrating Pinecone into its AI stack, Terminal X has delivered dramatic gains in performance, precision, and productivity, both for its users and its internal teams.

Institutional analysts now receive more relevant results, faster. Retrieval is no longer a bottleneck but a competitive advantage, helping users uncover exactly the data point they need, whether it’s a buried table in a regulatory filing or a line item in a proprietary model. The shift from document-level search to precise, context-aware retrieval has reduced cognitive load and improved the quality and speed of financial research.

These improvements have had measurable business impact. On average, users now save around three hours per day using Terminal X, and the time required to build investment memos has dropped from two days to just half a day. Since launch, daily query volume has scaled more than 100x, now exceeding 3,000 production queries per day.

Internally, Pinecone’s serverless infrastructure eliminated the complexity of scaling, allowing Terminal X to focus on high-value development like agent orchestration and finance-specific embeddings. Engineering teams doubled deployment velocity while reducing operational overhead, accelerating product delivery without compromising performance or reliability.

Since implementing Pinecone, Terminal X has:

- Significantly improved retrieval accuracy, with F1 scores increasing from 0.68 to 0.91 (0.93 for precision)

- Reduced average latency by more than 35% in key workflows

- Doubled deployment speed, enabling faster iteration and innovation

- Scaled seamlessly to support millions of documents and over 20 million embeddings

- Reduced system maintenance time by 25%

- Maintained consistent real-time performance with a median query latency of 51.7ms

With Pinecone, Terminal X transformed from a promising tool into a production-grade platform trusted by the world’s most demanding financial professionals.

Scaling innovation in financial intelligence

With a strong retrieval foundation in place, Terminal X is focused on expanding across more workflows, data types, and users. The team is actively broadening its ingestion capabilities to include new formats and asset classes, while integrating streaming data sources for even more timely analysis.

To continuously improve retrieval quality, Terminal X is developing real-time feedback loops that fine-tune how results are ranked and served. At the same time, deeper agent orchestration is underway, enabling the platform to handle more complex, multi-step tasks with greater autonomy.

As customer adoption continues to grow and financial research becomes increasingly AI-driven, Pinecone will remain a core part of the Terminal X architecture powering fast; scalable; and production-grade, knowledge-driven AI for the next generation of institutional investors.